ISMG is a global authority, linking professionals and businesses with cutting-edge technology, AI, and cybersecurity advancements via industry-leading news, research, dynamic events, strategic education, and specialized marketing services.

Our Brands

1.6M+

Subscribers

38

Media Properties

Media Network

ISMG's editorial brands deliver cutting-edge news, insights, and

analysis in cybersecurity and technology, engaging over 1.6

million subscribers globally with quality journalism and thought

leadership.

400+

Global Annual Events

20,000+

Attendees Annually

Global Events

Connecting industry leaders through education and networking,

ISMG's global events include summits, roundtables, and custom

events, designed to foster collaboration and innovation in tech

and security.

500+

Custom Learning Paths

30+

Custom Learning Paths

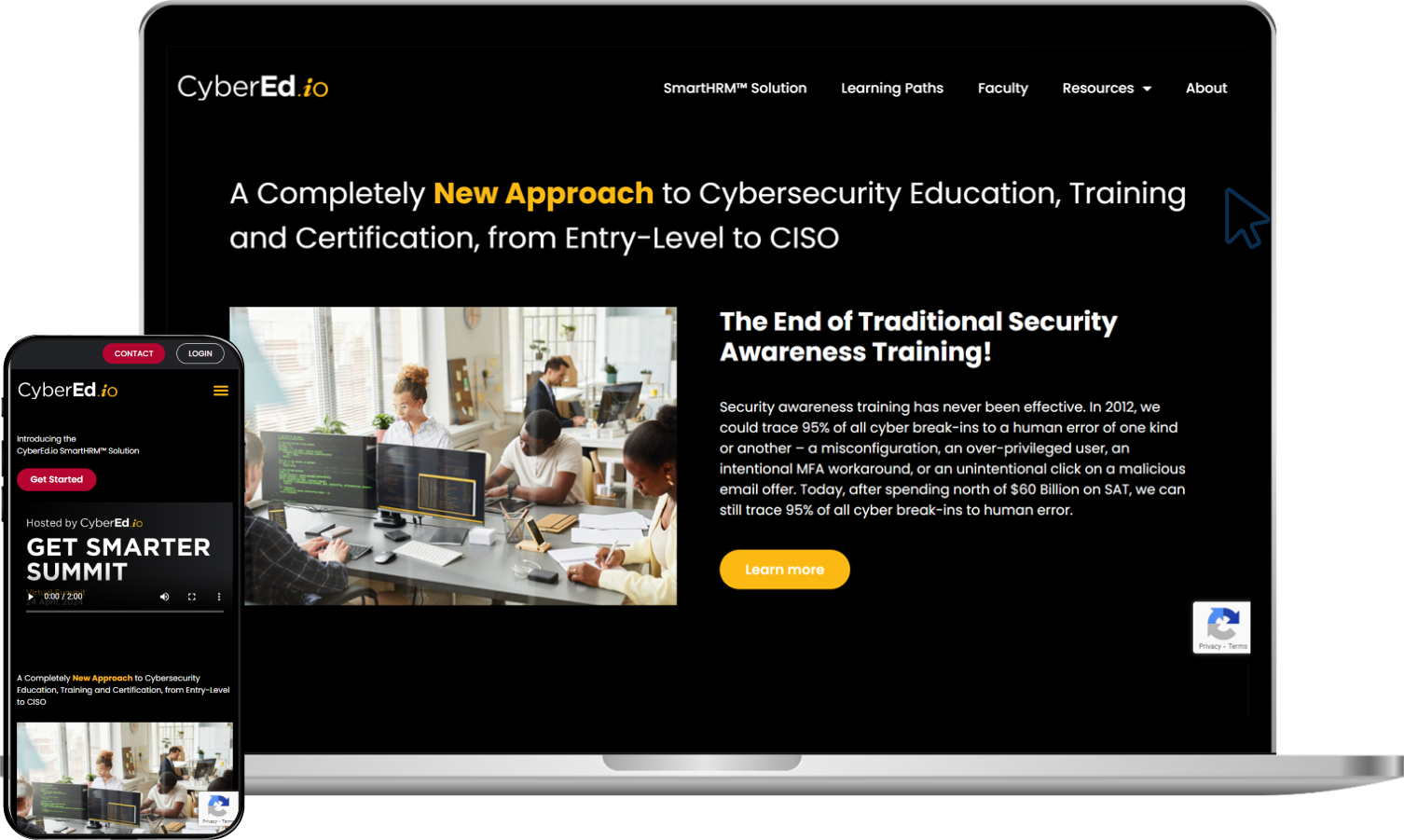

Through practical, real-world training, CyberEd.io bridges the cybersecurity skills gap, offering custom-designed learning paths from entry-level to CISO, curated by industry experts.

2K+

Members

91%

Attendees Annually

85+

Industries

75+

Countries

The exclusive CyberEdBoard community offers CISOs and CIOs a

platform for executive-level education and peer-to-peer

knowledge sharing, addressing today’s challenges in security and

IT.

CyberTheory advises cybersecurity firms with data-driven

marketing strategies, leveraging insider intelligence and

proprietary data models to optimize marketing outcomes.

Specializing in lifecycle marketing, XtraMile drives results

from engagement to retention, enhancing employer branding and

customer relationships with end-to-end marketing solutions.

CIO.inc focuses on the intersection of business and IT,

providing CIOs and tech executives with critical insights,

strategies, and thought leadership to navigate the digital

landscape.

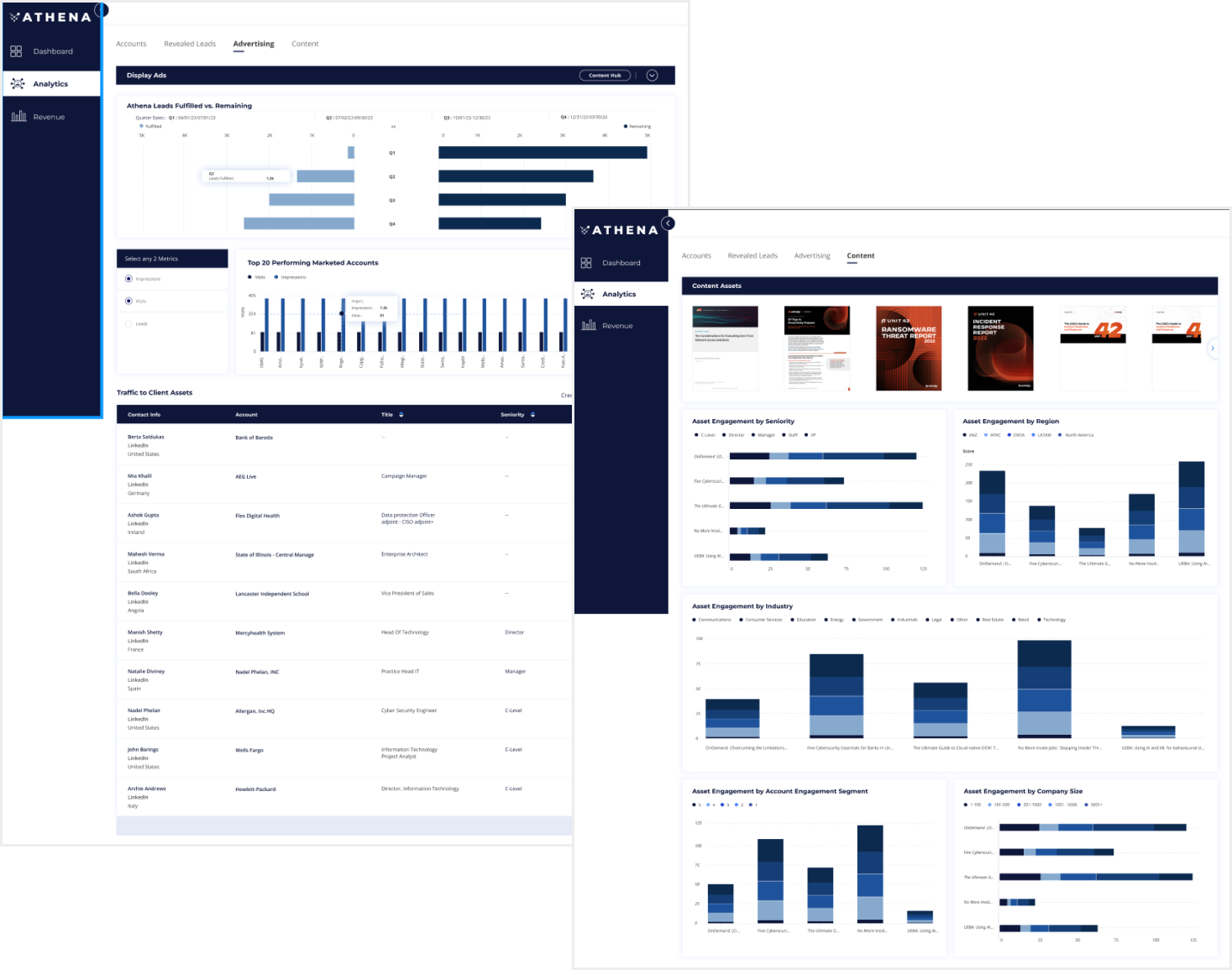

Athena offers actionable, contact-level buyer intent insights

based on proprietary data, giving marketers and sellers a

competitive edge in targeting and communication.